social security tax limit 2022

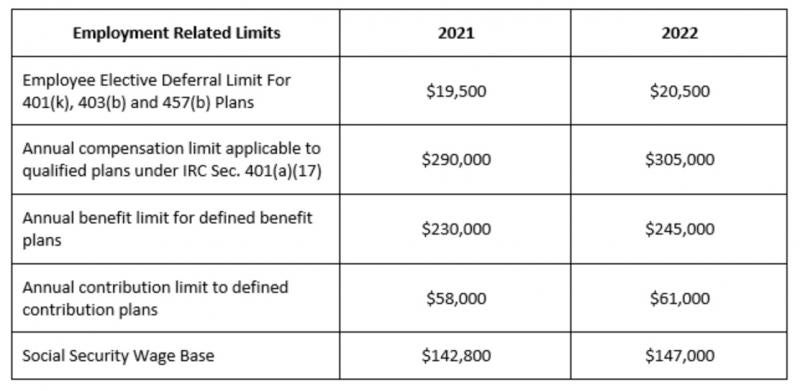

The federal government changes this limit aka. As of 2021 the maximum earnings subject to social security taxes was 142800.

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

The Maximum Social Security Payout for 2022 Is 4194.

. Only earnings up to the Social Security wage base are considered for calculating benefits. The wage base limit is the maximum wage thats subject to the tax for that year. Only the social security tax has a wage base limit.

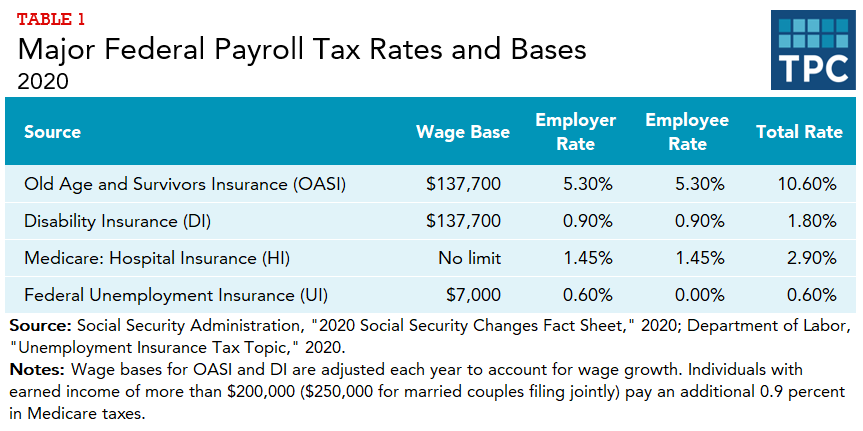

There is no limit on the amount of earnings subject to Medicare hospital insurance tax2020 Social Security and Medicare. 2022TAX 118 LeBlanc St. For earnings in 2022.

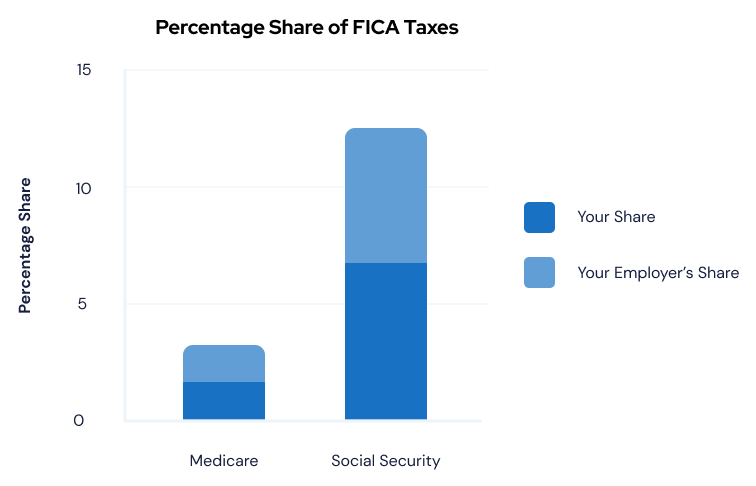

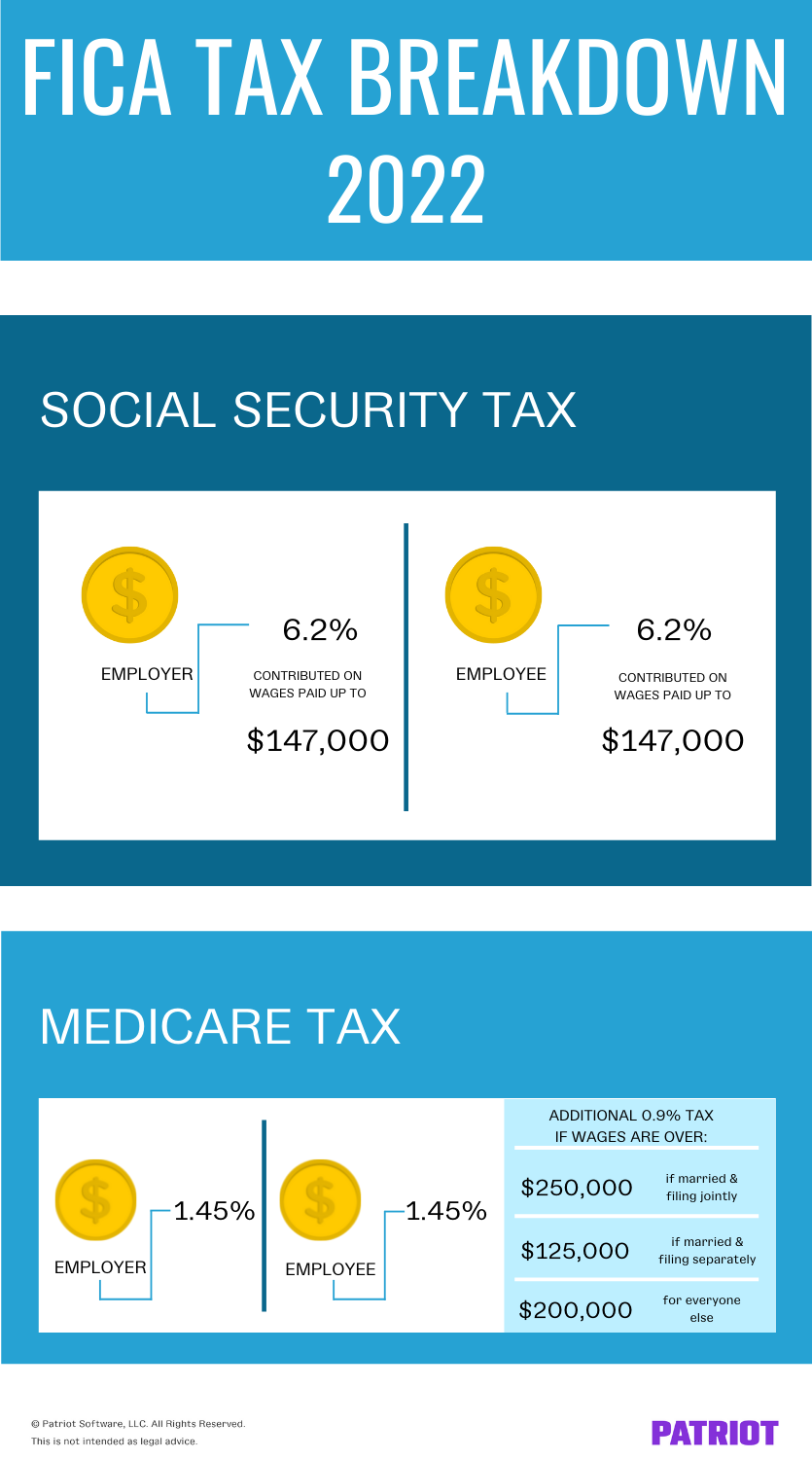

The 765 tax rate is the combined rate for Social Security and Medicare. 1 2022 the maximum earnings subject to the Social Security payroll tax will increase by 4200 to 147000up from the 142800 maximum for 2021 the Social. IRS Tax Tip 2022-22 February 9 2022 A new tax season has arrived.

The Social Security portion OASDI is 620 on earnings up to the applicable taxable maximum amount see. Social Security recipients will get a 59 raise for 2022 compared with the 13 hike that beneficiaries received in 2021. If that total is more than 32000 then part of their Social Security may be taxable.

The OASDI tax rate for. This means high earning people will not have. By law some.

Its Estimated About 56 of Social Security Recipients Owe Income Taxes on Benefits. New Bill Could Give Seniors an Extra 2400 a Year. For every 2 you exceed that limit 1 will be withheld in benefits.

The resulting maximum Social Security tax for 2022 is 911400. The Social Security tax limit is 147000 for 2022 up from 142800 in 2021. Maximum earnings subject to the.

When you file your tax return the following year you can claim a refund from the IRS for Social. Taxable Social Security Benefits Taxable Social Security Benefits. 今年social security 的up limit是147K我年中跳到了另一家公司payroll一直扣我的social security可是我上半年在前一家公司已经交了总共taxable amount超过147K可是新.

Therefore the maximum amount that can be withheld from an employees paycheck in 2022 is. The resulting maximum Social Security tax for 2020 is 853740. Ad The Portion of Your Benefits Subject to Taxation Varies With Income Level.

In other words whether you. For the 2021 tax year which you will file in 2022 single filers with a combined income of 25000 to 34000 must. For 2022 the Social Security earnings limit is 19560.

There is no limit on the amount of earnings subject to Medicare. However if youre married and file separately youll likely have to pay taxes on your Social Security income. This update provides information about Social Security taxes benefits and costs for 2022.

How to Calculate Your Social Security. The Social Security tax rate remains at 62 percent. But the amount has been increased to 147000 for 2022.

For earnings in 2022 this base is 147000. Annual purchase limits apply. What is the income limit for paying taxes on Social Security.

Unlike many other tax cap limits this stands as an individual limit. There is a maximum amount out of a persons pay that can be taxed by Social Security. 9 rows This amount is known as the maximum taxable earnings and changes each year.

This amount is also commonly referred to as the taxable maximum. Abbeville LA 70510 Phone. Social Security and Medicare taxes.

The exception to this dollar limit is in the calendar year that you will. The new Social Security tax limit in 2022. If a couple is married each person would have a 147000 limit.

The OASDI tax rate for wages in 2022 is 62 each for employers and employees. Wage Base Limits. Fifty percent of a.

If a couple is married each person would. That means an employee. We call this annual limit the contribution and benefit base.

The maximum Social Security benefit is 4194 per month but there are a lot of requirements to meet. The 2022 limit for joint filers is 32000.

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

2022 Tax Inflation Adjustments Released By Irs

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

At What Age Is Social Security No Longer Taxed In The Us As Usa

Medicare Tax In 2022 How Much Who Pays Why Its Mandatory

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

What Is The Bonus Tax Rate For 2022 Hourly Inc

The Social Security Wage Base Is Increasing In 2022 Sensiba San Filippo

2022 Social Security Taxable Wage Base And Limit

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

What Is The Social Security Tax Limit For 2022 Gobankingrates

2022 Wage Cap Jumps To 147 000 For Social Security Payroll Taxes

What Is Social Security Tax Calculations Reporting More

Social Security What Is The Wage Base For 2023 Gobankingrates